BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

B/D Owner Suspended for Supervisory Failures

Howard Lawrence Hull III agreed to pay a $20K fine and to not serve in a principal capacity for 3 months to settle FINRA charges that 2 registered reps associated with his member firm participated in private securities transactions that Hull approved but failed to supervise, and failed to record on the firm’s books and records.

BACKGROUND. Hull, a resident of Costa Mesa, CA, has 19 years’ experience with HLH Securities - which his father founded and ran. From most of the period, running from 1996 to 2015, Hull served as the firm’s VP, CCO, and FinOp, and he was the sole registered principal responsible for all areas of the firm’s supervision - including its WSPs and maintenance of the firm’s books and records. He holds Series 7, 24 and 27 licenses. The firm's membership with FINRA was canceled in 2015 for failure to pay ~$2,700 in outstanding fees.

While associated with HLH Securities, Hull was also associated with, and registered with FINRA through, 2 other FINRA member firms – PMB Securities from 2005 to 2009, and Finacorp from May 2007 to 2010 (probably as a Rent-A-FinOp). He currently is not associated with a FINRA member firm. Hull has no prior disciplinary history.

FINRA FINDINGS. Between August 2012 and January 2014 (the "Relevant Period''), while serving as his firm’s sole supervisory principal, Hull failed to: (i) establish a system reasonably designed to supervise and failed to supervise private securities transactions (“PSTs”); (ii) update the firm's WSPs to address the requirements of FINRA Rule 3270 and to conduct the required review under that rule; and, (iii) review, retain and supervise certain business-related emails and to establish a system, including written supervisory procedures (“WSPs”), reasonably designed to supervise the review and retention of business-related emails.

1. Failures to Reasonably Supervise Private Securities Transactions. During the Relevant Period, 2 registered reps associated with HLH Securities participated in 21 PSTs that Hull approved but failed to supervise and failed to record on the firm's books and records. HLH Securities did not require the registered reps to provide Hull with documents and other information related to those approved PSTs, precluding him from supervising the activities and recording the transactions on the firm's books and records.

2. Failures to Supervise and Review Outside Business Activities. Between July 2012 and December 2013, 10 registered reps provided Hull with written disclosure of outside business activities (“OBAs”). Hull approved each of these activities at the time they were disclosed but failed to conduct any required reviews.

3. Failures to Review, Retain and Supervise Emails. Despite the fact that HLH Securities prohibited its registered reps from using email for business-related communications, Hull used and allowed 10 registered reps to use personal email accounts to conduct firm business during the Relevant Period. As a result, Hull failed to:

- review or retain all business-related emails sent from or received by the registered reps’ personal email accounts;

- supervise the use of these accounts; and,

- enforce the firm's procedures prohibiting use of personal email to conduct firm business.

FINANCIALISH TAKE AWAYS. HLH Securities principally involved itself in just 3 types of businesses - (i) selling tax shelters of limited partnerships in primary distributions; (ii) private placements of securities; and, (iii) retailing and wholesaling of private placements. So, one might think that maintaining compliance wouldn't be terribly burdensome for a single person.

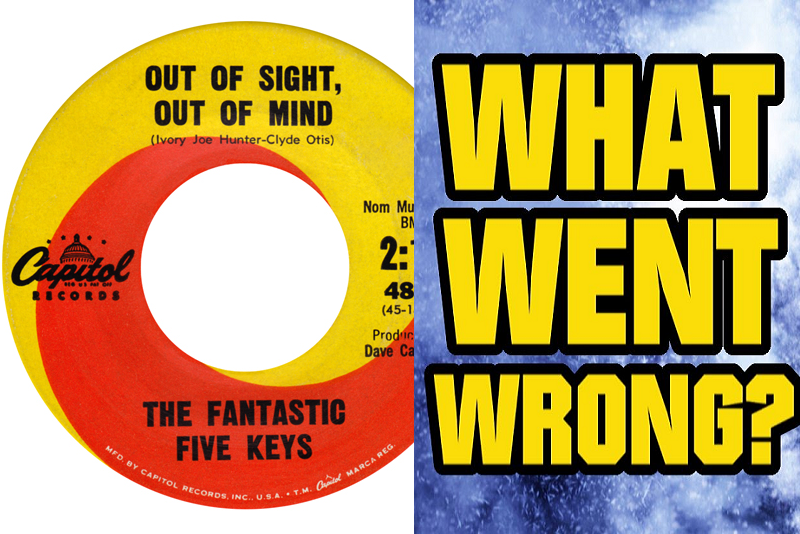

"OUT OF SIGHT, OUT OF MIND!"

Yet, Hull failed to do so - either because he took his eye off activities that occurred away from the firm - private placements, outside business activities, and personal email - or because he was noncommittal to maintaining complete compliance. After all, FINRA found that Hull, himself, used personal email for firm business.

Just like a drowsy driver needs to pull off to the side of the road and load up on some caffeine, a negligent Chief Compliance Officer must recognize when it's time to delegate supervisory responsibilities to another individual. It just makes sense while keeping reputations and pocketbooks intact.

This case was reported in FINRA Disciplinary Actions for October 2017.

For details on this case, go to ... FINRA Disciplinary Actions Online, and refer to Case #2014038992501.