BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Broker Forged Client E-Signature and Reported False Residential Address on Form U4

by Howard Haykin

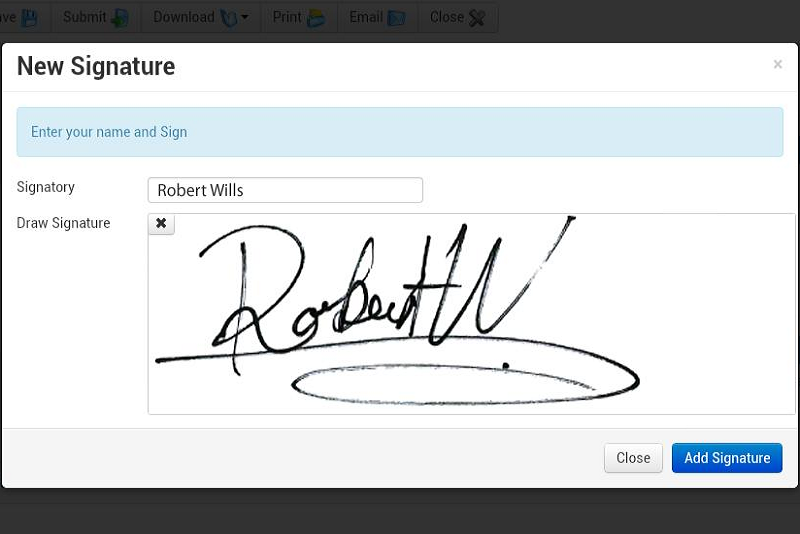

Jeffrey Delaney Jr. agreed to pay a $15K fine and serve an 8-month suspension to settle FINRA charges that, without a policyholder’s knowledge or authorization, he forged the policyholder’s electronic signature on forms related to the exchange of her existing life insurance policy held with his member firm’s affiliated insurance company and submitted them for processing.

FINRA further noted that Delaney had willfully reported a false residential address on his Form U4 and responded in his employer’s periodic compliance attestations that his Form U4 was accurate.

BACKGROUND. Delaney, a resident of Peachtree City, GA, has 2 years’ experience with 2 firms. He held the Series 6 and 63 licenses. From January 2015 until August 2016, Delaney was associated with Pruco Securities, LLC. He currently is not associated with a FINRA member firm. In its termination notice, Pruco Securities reported the following allegations:

► RR electronically signed customer's name to life insurance application and did unauthorized 1035 exchange;

► Stated U4 inaccurate residential address & gave it to 2 insurance regulators for licensure, inaccurately, as resident agent in State 1 and non-resident agent in State 2 to avoid State 2's required insurance exam;

► Did not obtain sufficient know your customer (“KYC”) information for life insurance applications; and,

► Used office space without firm approval & without adequate safeguards for customer information.

FINRA FINDINGS - FORGERY. In September 2015, Delaney met with “RT,” a customer of the Firm's affiliated insurance company, concerning the potential exchange of existing life insurance policies that RT and his wife, “ST,” held through the Firm Affiliate. Some 9 days later, Delaney forged the wife’s electronic signature on 7 forms related to the exchange of ST's life insurance policy for a new one - without her knowledge or authorization. The forms were subsequently submitted to the Firm Affiliate for processing.

FINRA FINDINGS – FALSE RESIDENTIAL ADDRESS. In January 2015, when Delaney joined Pruco Securities, he resided at an address located in Georgia (the "Georgia Address"), while his office was located in South Carolina. In March 2015, his Form U4 was amended to report that his residential address had changed from the Georgia Address to an address in South Carolina (the "South Carolina Address"). However, this information was false. During the entire period of his association with the Firm, Delaney resided at the Georgia Address. While he was associated with the Firm, he never resided at the South Carolina Address.

Delaney's reporting of the South Carolina Address as his residential address enabled him to avoid the State of Georgia's insurance licensing requirements for residents of the State. Delaney was fully aware that his reporting of the South Carolina Address as his residential address on his Form U4 was false. Delaney's false reporting of his residential address on his Form U4 was willful.

Form U4 requires the disclosure of the associated person's current residential address. The Form U4 requires an associated person to "update this form by causing an amendment to be filed on a timely basis whenever changes occur to answers previously reported."

FINRA FINDINGS – FALSE ATTESTATIONS. During the Relevant Period, Delaney submitted 5 periodic attestation forms to the Pruco Securities which asked Delaney to confirm the accuracy of the information on his Form U4. Each attestation form identified the South Carolina Address as Delaney's residential address on his Form U4. In each attestation form, Delaney represented to the firm that the information in his Form U4 was “true and complete to the best of [his] knowledge." These statements were false because Delaney's Form U4 reflected a South Carolina Address that was not Delaney's true residential address.

FINANCIALISH TAKE AWAYS. In the grand scheme of things, Delaney’s forgery was, in my opinion, the most significant violation in this case. Yet, I prefer to focus my ‘take aways’ on Delaney’s falsification of his residential address – which FINRA concludes was done to avoid the expense and inconvenience of having to register for an insurance license.

That’s a persuasive reason for committing such a violation [mind you, I didn't say valid], and it’s surprising that FINRA doesn't report more cases involving this type of violation. Perhaps it’s just a matter of time before FINRA cracks down in this area or initiates a sweep examination. And, as happened in this case, registered reps typically compound such violations by attesting on their annual or periodic compliance questionnaires that the information on their Forms U4 “is true and complete to the best of their knowledge.” [Financialish readers will know that I think FINRA is “double-dipping” when it sanctions brokers for both a rule violation and for the "cover up" - i.e., when the broker "is caught lying” on annual compliance questionnaires.]

Compliance officers should consider referring to this case in their Continuing Ed Programs – i.e., use it as a warning to registered reps on the downside to lying on one’s Form U4 and annual questionnaires. If you get one convert among the firm’s registered reps, you’ve made progress.

This case was reported in FINRA Disciplinary Actions for September 2017.

For details on this case, go to ... FINRA Disciplinary Actions Online, and refer to Case #2016051308001.